Calamity has domestic and internationally actually, american stock market is in perfect before, also had produced a calamity of all sorts of types. From in those days Dutch tulip incident begins, this kind of man-made disaster never has stopped, was to changed a view to changed a form to stop nevertheless.

From development course looks, a the development course that does not arrive 30 years only, and the history that foreign stock market has on hundred years at least, also had experienced a calamity.

A development course of 30 years criterion more the stock market epitome that resembling is Euramerican country, accordingly, look the frequency of a calamity happening wants a few taller.

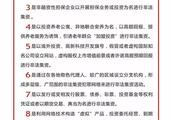

Look from system respect, at present A system construction lags behind at stock market development far, partial orgnaization and flaw of individual interest system, sudden huge profits of obtain a huge sum, abet on certain level of the market rise to fall greatly greatly.

From the market superintendency angle looks, superintendency orgnaization also is to be in continuous study, ceaseless progress, and occasionally this is planted ascensive lag the behavior at market adventurer, this also offerred the market speculator with an opportunity given by, make the market appears to fluctuate considerably.

Look from investor angle, a be in the majority with individual investor, and the investor that has professional investment capacity is opposite less, namely immature investor is in the majority, and these investor get the market extremely easily again short-term wave motion or the message influence without test and verify, chase after go up kill drop, this also aids those who pushed the market to fluctuate considerably greatly.

From investment orgnaization behavior looks, occasionally orgnaization investor is based on some kind of purpose, need undertakes moving storehouse or other action, short-term inside be bought considerably or sell piece, also can cause the market to fluctuate considerably.

Must remember: Eat one chasm, long one wisdom, harm even if understand, fail even if know. We can be walked out of slowly from inside suffer a defeat, pick up confidence again, not happy, regret, complain with fluster the investment to you is without a help. The stock market is very main, but not be the life certainly is all, besides the stock market, we still have poem and distant place, this ability is the life that we should have, continue our effort and pursuit.

12 when decide profit and loss fry a true classics1, the place of rich play chess that the stock market is psychology and capital forever, without good state of mind, protect consciousness without capital, should be necessarily in the stock market disastrous defeat.

2, " cannot help buying a share, hate to part with sell a share " it is we come loose the biggest reason of a deficient money. We come loose door respect, news channel respect, research is measured to analyse respect of relation of arteries and veins of respect, person in capital orgnaization of be not a patch on, so we can perfect ourselves only -- before buying a share, bear, when selling a share a few more decisive, "Corrupt " and " be afraid of " it is two dagger with the sharpest stock market.

3, the happening of traffic accident, because inobservant traffic is regular,be for the most part. Not be achromatopsia, can see traffic light, however sad is a lot of people " turn a blind eye to " ; Because the technology closes nevertheless,major loss is not in the stock market, however because of inobservant discipline, stop to what oneself decide caustic and stop be filled with a most is to exist in name only.

4, any moment do not depend on others, the most reliable in the stock market is him. Bow for the orgnaization with its, learn research as oneself well, perfect oneself.

5, stock market strictly speaking is field of a high play, just be allowed by the country. So to us for these shareholders, since entered the stock market this gambling house, wish to bet be about admit defeat, the stock market makes money deficient money is very regular, the most important is not to want to give put out of order his state of mind. Because,major gambler is addle of state of mind, be immersed in thereby have a deficit ceaselessly the vicious circle of money.

6, there is an expert inside the stock market, only loser is mixed win the home. Expert also may not is to win the home, not be an expert also may not is loser.

7, learn too much analysis method not blindly, because learn blindly,be used to can let us lose the basiccest ego to protect consciousness only. What knowing is gold is broken up, what is wave theory, know how to see forms for reporting statistics, knew to analyse market information, forget easily however " stop caustic maintains an order " this the basiccest principle.

8, we always are full of curiosity to strange thing, always change often so; However strange thing is full of sealed risk, a lot of we do not know they are to attribute which trade, whether had knowing been exalted, do not know to rise the reason of backside, with respect to blind average, the result is disastrous. Accordingly, change often cannot take, change often increased us the new move to the stock market, change often ending is " buy drop, sell go up " , and miss advocate rise billow, change an one of the biggest reasons that are our deficit often.

9, the risk is to go up come out, the opportunity is to drop come out. The truth of Things will develop in the opposite direction when they become extreme. also exists in the stock market, accordingly, according to this theory, after we are going up rationally greatly, exit, grab after dropping greatly into. Converse thinking, it is a very useful thinking in the stock market. We want to know, the stock market turns over human nature.

10, grail analysis is admittedly serious, but of our buying and selling is, we cannot buy grail. Accordingly, time of little beautiful place is analysed and discuss grail, floriferous dot time knows the company that he buys, understand the management situation of the company, understand the development situation of the company, understand the shareholder situation of the company, know the technical extent of the stock, understanding stock has what orgnaization to participate in... these businesses that affect our profit and loss directly, just be the most important.

11, what can buy is prentice, what can sell is a master, of can empty storehouse is a private assistant attending to legal.

12, medicinal powder door actual strength cannot be compared with the orgnaization, accordingly, we need to fight neatly. The first, we should use bushfighting, hit so that win to be hit, dozen do not win to run; The 2nd, we should use protracted battle, gaze at after a stock, do not want to abandon easily, an any stocks can have one each years arrive twice advocate rise billow, want to be able to be captured only advocate rise billow, making money is not tickler.

What is the essence of Chinese stock marketEnd by June 2017, china has had more than 120 million shareholder, that is to say about the same every 10 people have a shareholder. Have a meal in cafeteria when you or when the car such as subway station, public transportation station, you may hear the person beside to talk about a stock to perhaps look fry a software, even the uncle aunt of the village also regular meeting collect communicates together fry a result. So, does everybody suit to fry really?

Above all what is we will issue a share a little. The stock is the droit certificate that joint-stock company issues, it is joint-stock company issues each partner to plan market fund to regard as support an evidence and a kind of negotiable securities that so as to acquires dividend and bonus. Every stock owns the property of a main unit to the enterprise on behalf of partner, rear one appears on the market company.

The stock market is the abbreviation of stock market, it is to appear on the market constitutionally the enterprise is mixed for financing dispersive risk. Actually, stock market is the market of repartition of a fortune, do not generate wealth directly. The fund that you gain is the money that people loses, the stock market is belonged to " 0 with game " . Generally speaking, 10 people are fried 7 have a deficit 2 make the same score 1 to earn.

If have a share, it is the business that stability of one property performance grows rear, the person that buys this share in succession chooses not to sell, await the share out bonus after this company profits, so this stock did not clinch a deal basically quantity, share price can rise point-blank. In fact, this is good position, as a result of enterprise outstanding achievement degree of fluctuant, information control differs even the person's mood changes, these elements can affect share price change.

Exceeded its intrinsic value when share price, with respect to meeting occurrence bubble; When share price under its intrinsic value, with respect to occurrence opportunity, because it can go up finally,return its intrinsic value.

Ever raised a such questions to audience on seminar of a lot of investment: "Who is ever in the market be out of pocket? " about the same metropolis handle raises each person come. Next I can ask then: "How many person is there to earn money again in you came back -- in the market? " almost metropolis handle puts down everybody.

Banker and medicinal powder doorA banker, after he chooses a stock to enter, chose a shop front like a businessman, lease the one part that oneself make live after fall or be being bought, business share is replenish onr's stock and shipment. Need to be run for a long time generally speaking, a few years longer perhaps. So medicinal powder door? It is passing traveller for the most part. What meaning? See this store business is good namely, buy bit of goods to be being placed in inn doorway in this inn instantly sell rise, what what hope is shop can the goods huff distribute, oneself also can sell last good values. This is indifferent to when the business flourishs, because of enough business, shop carries valence to still can sell, the goods nature that you approve can touch bit of light, earn bit of price difference. But to how to meet when is the business fatigued and weak? Natural meeting compensate drops capital. The key here counterpoises with respect to the price that is shop. Your goods is approved in this shop above all, that explains, a series of trade data such as your cost, amount, price are not had close insurable, shop boss nature knows as clear as dayly, is when is the business delicate the boss can let you sell a likelihood the customer that he sell an object? Absolutely won't.

How can be he done then? Hawk in order to compare your low price to others. Because you wait for utterly ignorant to the boss' cost and amount, you can move finally only with smaller than boss price measure, and the likelihood buys you who is you may not know the person of this product. That is to say, the activity of shop boss is in behind the curtain, your activity is in however the eyelid of shop boss is low, bad of what actor what? Be clear at a glance. It is more important to still have a bit, the time idea of passing traveller and shop boss. Shop boss is to be managed for a long time, he is OK brushstroke brushstroke, or a few months are horizontal dish manage slowly, because he has fixed place, fixed goods. And Where is passing traveller? If move not in time,approve the goods that come, equestrian jacket feeds can care. Of the identity not quits brought about medicinal powder door it is difficult to earn banker money, and banker existence price counterpoises, earn come loose a money is relatively some easier.

Said to come loose above a different point with banker, should have now medicinal powder door the friend is about to ask, since such, that I how the money of ability gain banker, actually this problem is the easiest answer, it is for certain " with the village in all dance " " , the share that has a place of business is a treasure, the stock that does not have a village is careless like the root. Buy a share, go with the village, ability can win victory in the market, all-conquering is accomplished in the market, invincible. Although say all the time banker and come loose an enemy that is absolutely irreconcilable, but after all banker has abundant financial capacity, have professional talent group, they can accomplish consider the situation, meet low induct, meet decrease a pound high. With the strategy investment sets avoid venture. And to coming loose door, capital scope is little, technical tool is lacked, information not free, time energy is insufficient, operation level is not high. All these, was destined to come loose a banker of very difficult conquer, the be the banker with banker successful every time, it is deceit comes loose door process.

Banker state of mind:

Come loose a state of mind:

Generally speaking, brunt is held dish should prepare through sucking, wash dish, pull raise 3 level.

When orgnaization, banker values some share, can buy gradually when share price is inferior. Because brunt enters capital amount is very large, to deceive the public, be in commonly very a paragraph long enter group by group inside period, we are aware of very hard.

After building a storehouse to end, brunt to increase profit, can disperse door wash go out. Washing dish of method no more than is long horizontal dish (banker trades profit with time, those who do not boil can be washed to go out) , violent perhaps dozen control share price (cost comes loose high door be not carried, can be washed to go out) .

After washing dish of end, brunt accuses dish of degree to promote furt22 " does liquor pass through periodic " ? Are these people in 2013 up to now does sound where?