Buyer borrows money and discredit gets stuck to be without connection almost, besides your credit card on time the individual credence record that reimbursement can be included you, but the wage that buyer wants to see you, head pay, a series of elements such as emeritus age, the action very little of credit card.

Borrow a record to the room now examine and verify is very severe also, had borrowed previously cannot borrow again.

Credit card is right the advantage of the person that use, besides can consume first, money is returned after, integral exchanges a gift, wait advantage a moment besides, returning some profit is, the person that can let use has credit record.

But, have good side and bad side at this o'clock, exceed reimbursement period to was not returned, influential still to you, nevertheless now and then a few, think to you loan buys a room to affect not quite.

Mortgaged house, if once have what thing, the bank can be auctioned or other method deals a room, so the bank can borrow money mortgage buy a house.

But behind still have other issue, if the bank lowers loan interest rate to a few clients, for example before blast what allowance, record good high grade client in the light of credit namely of course.

Credit card has loan to buy a house to loan influential

It is relative that loan buys room and credit card, meeting influence loan buys a house if credit card exceed the time limit is serious.

The consequence with credit card serious exceed the time limit: 1, accrual of generation exceed the time limit and fine for delaying payment; 2, the bad record that sign a letter; 3, the bank will be urged close, the likelihood faces criminal problem.

File the requirement that the room borrows: There is fixed dwelling place in loan bank seat, have constant resident opening or live effectively proof; The age is in 65 one full year of life (contain) the following, China citizen that has capacity of completely civil action; Have proper profession and steady income, have repay on schedule the ability of loan principal and interest; Have good credit record and reimbursement desire, do not have undesirable credence to record; What can offer a bank to approbate is lawful, effective, reliable assure; Have clear loan use, and loan utility accords with relevant provision; Account of individual settle accounts is opened in the bank; The other condition that the bank sets.

Remarks: Credit card should on time reimbursement, exceed the time limit can affect an individual too badly to sign a letter, influence individual borrows money.

. . .

A lot of pieces of credit card can affect loan to buy a house

Spread out to want credit card only entirely not exceed the time limit won't affect loan to buy a house.

Conduction bank mortgages the requirement that needs preparation: 1, have legal resident status; Apply for housing of policy sex individual to borrow money, due mouth of local constant housing; 2, the profession that has stability and income; 3, have repay on schedule the ability of loan principal and interest; 4, the capital fund that loan is approbated all right undertakes guaranty or impawn, or (and) the guarantor that accords with rated condition assures for its.

5, have the contract that buys housing or agreement; 6, when putting forward loan to apply for, in construction the bank has not under buy housing place to need capital the deposit of 30% , apply for housing of policy sex individual to borrow money, should building accumulation fund of bank deposit housing by the regulation; 7, the other condition that loan sets all right.

Conduction bank mortgages the data that needs preparation: 1, loan application form; 2, subscribe agreement or business contract; 3, identification; Identification is to point to: The pass of personage of the passport of foreign nationality personage, Taiwan and census register this, card of the Id of HongKong and Macow, return to one's native place, if be in what Shanghai works, need to offer employee's card.

Marriage proves to show the place country of the person that buy a house and spouse registers a proof, if be in what Shanghai works, need to offer the marital proof that Shanghai company opens only.

Financial condition proof is the domestic year finance affairs that shows foreign nationality personage is in office of congress plan division report, stock trades governmental tax is odd, only.

If be in what Shanghai works, need to offer Shanghai to be in the income proof of the company only.

4, income proves (include record of duty sheet, bank deposit and employer confirmation) .

. . .

Credit card has money currently, can you borrow money buy a house?

Can borrow money buy a house.

Credit card itself uses what consume ahead of schedule namely.

So you and currently debt did not concern, want you only credit is good (on time reimbursement) can borrow money, if you once had reimbursement of exceed the time limit, even if, loan estimation is very troublesome also.

If amount of exceed the time limit of credit card debt is lesser, not big also to the influence of loan.

Before loan, the bank can inquire the individual of borrower asks for a letter to record, if have exceed the time limit bad record, your loan can have a lot of troubles, although can do to reckon the meeting of interest rate rise is taller (10% in standard interest rate- - 50% between rise) .

In the meantime, more or less to mix according to what you need to borrow money loan utility, silver-colored guild checks your individual running water, individual asset, have some of moral quality that inspects you even, of every bank pay attention to a dot to have distinction, each other connects a few basic materials between the bank.

Must hold a good convention that use card so, do not enter ask for the blacklist in the letter.

Credit card returns money now, whether can you affect the loan that buy a house?

Credit card still is owed now, if be consumed normally,use only, on time reimbursement of full specified amount, do not affect the loan that buy a house; Application buys a house loan, should sign a letter only good, accord with a bank to set, can apply for; Consult the data that the loan that buy a house needs: 1, skill room mortgages need of loan loan procedures: The identification of both sides of usurer husband and wife, registered permanent residence this, card of authority of marriage certificate, room (business contract) , land card (or Xerox) , the proof that do not have a room, unit income proof, assure of the company assure proof.

Deal with skill room to mortgage by development business collective commonly, simpler.

2, secondhand the room mortgages need of loan loan procedures: Identification of both sides of husband and wife of buying and selling, registered permanent residence this, card of authority of marriage certificate, room, land card (or Xerox) , bill of tax of business contract, agree, evaluate income of husband and wife of report, buyer proof and the proof that do not have a room.

Can credit card affect a room to borrow

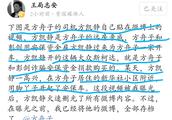

Spread out all high specified number spends credit card to be able to affect a room to borrow actually examine and approve mortgage buy a room to return credit card lot first: This year citizen Fu Xiang of 35 years old (alias) the middle-level that is an institution, have fixed income, any loan had not been made before, but his under one's name has 10 pieces of credit card, always overdraw the forehead is spent in the RMB 350 thousand yuan are controlled.

Fu Xiang explanation says, use credit card is convenient, go consuming at ordinary times need not take ready money, plus brush credit card consumption to have dozen fold, cheer have privilege, so long-term nurturance the habit that consumption brushs credit card, hand in property cost to brush credit card even.

"A little oneself handle these credit card, bank staff promotes some actively.

Because have fixed income, so the forehead with card spends much Zhang Xin to be in RMB 50 thousand yuan of above, the RMB is as high as after some courses raise the specified number nearly 100 thousand yuan.

" had high specified number to spend credit card, fu Xiang some " be pleased with oneself " , those who feel these card are the identity is indicative.

Nevertheless, fu Xiang prepares to buy a room to do recently when mortgaging, the trouble came, fu Xiang is informed by the bank: Credit card forehead is spent is to be equivalent to a bank approving your loan specified amount to spend beforehand actually, using this forehead to spend was to use loan specified amount to spend actually, just have 50 days avoid breath period just.

This forehead is spent used be equivalent to borrowing money to the bank, can affect mortgage buy a house especially accumulation fund mortgages loan to buy a house, so the bank suggests Fu Xiang returns all credit card money first, just apply for to buy a room to mortgage to the bank.

This Fu Xiang is deficient big, a few in installment although big spending can shift to an earlier date reimbursement, but in installment poundage still gets sum to illuminate close, 50 thousand yuan consumption divides brushstroke RMB 12 period poundage sum closes have to nearly 5000 yuan.

Fu Xiang has 3 big spending, shift to an earlier date reimbursement poundage have to loss 10 thousand multivariate.

Be in knowing credit card forehead is spent is actually after approving loan specified amount to spend beforehand, fu Xiang begins to want to cancel a few pieces of credit card, but formalities is very troublesome, cannot pass bank bar, can the phone sells card, and much Zhang Ka must be in become effective of 40 days of ability after cancelling.

Once allowed the credit card of high specified number that Fu Xiang admires in the heart, make him vexed however nowadays unceasingly.

Credit card of high specified number affects loan bank: Use high specified number to spend credit card to you can be affected mortgage buy a room to buy a car? The reporter visited much home bank to this.

The manager of a client that golden trade subbranch of a bank goes in expresses, overspend high specified number spends credit card to be able to affect loan to mortgage those who buy a house to examine and approve really, the person that buy a house accordingly is being dealt with big credit card had better not be used during mortgaging loan, and still had better be over credit card debt, cannot have record of exceed the time limit more.

A chief of subbranch of a bank of pasture of restful bank of great capacity says, the bank is done when buying a room to buy a car to mortgage loan, report of the income proof that can pass inquiry individual above all, credit will undertake assessment, the specified number that used credit card is spent with respect to use individual actually loan specified amount is spent, credit card forehead is spent with much affect a bank possibly to examine and approve the speed that mortgages a paragraph and forehead to spend.

The Zheng director of branch of big talk of the bank that enrol business says, credit card overdraws belong to an individual to be in debt, credence of individual of Lv of the unified exam when the bank is making the loan that buy a house and the ability that offer a fund two respects.

Nevertheless, manager of client of much home bank also expresses, credit card does not affect loan without what undesirable credence records, but dealing with loan of some bank business to be in those who examine and approve level commonly, it is not to allow to there is big money in other bank, otherwise bank loan has been examined and approve hard.

Additionally the reporter still understands, at present each bank does those who buy a room to buy a car to borrow money to basically consult to the individual is people bank the individual credit report of the center that sign a letter, the individual asks for a letter to be updated by the month, credit card reimbursement can not be in the system that sign a letter real time is newer, when was not updated the bank undertakes inquiring, it is to calculate to circumstance of individual credit respect indebted.

Credit card appropriate is little unfavorable remind more: A company controller Chen Guanghao that manages tripartite to pay thinks, resemble the situation that Fu Xiang encounters, it is the individual is opposite above all credit card forehead spends the situation that did not understand adequately to fall, think the forehead spends the credit card of application to had been jumped over higher, but a lot of foreheads spend the credit card in 300 thousand above is loan card actually, and did not avoid breath period, the very much person that hold card is right this however not know the inside story.

Additional, each bank is popularizing credit card to perhaps emphasize using credit card only to the person that hold card in credit card manual go to the lavatory and consume privilege, did not remind the person that hold card excessive overdraw meeting influence other borrows money, and shift to an earlier date in installment to consumption reimbursement must sum returns the case such as poundage, also did not explain or make important clew.

The reporter still understands, many banks have job of credit card hairpin each years, did not eliminate to a few clerks handling card are measured to finish the job and conceal those who use high specified number to spend credit card painstakingly " hidden trouble " .

The reporter is passed to much home bank borrow client manager to understand, a person had better be dealt with two to 3 pieces of credit card, reasonable use can bring to the life convenient, certain privilege is enjoyed when consumption.

Conversely if handle credit card too much or the forehead is spent too tall, use be about careful, lose card to was not cancelled in time, the record of credence of meeting influence individual such as reimbursement of exceed the time limit, overdraw exorbitant can affect other loan.

The reporter is passed to much home bank borrow client manager to understand, a person had better be dealt with two to 3 pieces of credit card, reasonable use can bring to the life convenient, certain privilege is enjoyed when consumption.

Conversely if handle credit card too much or the forehead is spent too tall, use be about careful, lose card to was not cancelled in time, the record of credence of meeting influence individual such as reimbursement of exceed the time limit, overdraw exorbitant can affect other loan.

Credit card exceed the time limit ten, can affect loan to buy a house

Credit card exceed the time limit ten, affirmative meeting affects loan to buy a house.

1, more or less can credit card exceed the time limit affect application loan to buy a house, current, the bank is those who carry out " connect 3 tired 6 " policy, be like accumulative total of frequency of exceed the time limit more than 6 times namely, odd perhaps time of second exceed the time limit exceeds 3 months, that is handling any loan and credit card.

2, want credit card to had appeared only normally exceed the time limit, oneself credence can produce undesirable credence record in the record, affect the application of loan then.

But the bank also has a level commonly, can put twice normally now and then borrow, but loan interest rate may be increased or limit loan amount 3, if for many times, time of second exceed the time limit grows sheet, can be regarded as baleful exceed the time limit, the room cannot be dealt with to borrow in any banks, the car is borrowed etc.

4, if borrower appears really the circumstance of credit card exceed the time limit, because undesirable credence record saves 5 years of time only commonly, during this inside, want reasonable use credit card only, on time reimbursement of full specified amount, wait on 5 years, can deal with a room to borrow likewise.

Suggest everybody had better be the consumptive habit with reasonable nurturance and good reimbursement convention at ordinary times, as far as possible on time reimbursement, do not want the room that be bought by block up of credit card exceed the time limit, way that buys a car.

Does loan buy a room to must pay off credit card

Set to the debt of credit card must be paid off before borrowing money without the bank, but when some of bank examines and approve the forehead to spend in computation, can owe credit card as indebted computation, spend to loan specified amount so can decrease; Spread out to if credit card goes in lowermost reimbursement,do not pass entirely, also explain reimbursement ability is not very strong, of ability of reimbursement of Lv of bank unified exam; If the hand is medium rich, change the money in credit card first certainly, because of the accrual of reimbursement of credit card lowest actual computation rises than 18% even tall, if borrow 5 years of above with the room 7 change favourable interest rate 4.158% will calculate, borrow interest rate to want tower above than the room 3 times much still, be very wasteful money.

Loan buys a house: Point to the person that buy a house the Lou Yu that with be in housing trades is on mortage, to the bank application borrows money, use at paying to buy house fund, the loan business that repays captital with interest to the bank in installment by the person that buy a house again, also be called building guaranty borrows money.

The room is borrowed, it is the application that borrows money to guaranty of building of bank fill in a form and submit it to the leadership by the person that buy a house, the proof document that if the place regulation such as contract of business of proof of Id, income, building, deed of security must be referred,offers legal document, bank classics investigates qualification too, extend to acceptance of the person that buy a house loan, and the mortgage loan contract that the building business contract that the person that the basis buys a house offers and bank and place of the person that buy a house conclude, conduction estate guaranty is registered and notarial, the bank borrows place inside the time limit that the contract sets on the account that the fund that give delimits unit of carry out house is in this directly.

Extend a data: Influence loan buys room fixed number of year and room to borrow the element of deadline: The age of loan applicant: The bank is in when evaluating a room to borrow reimbursement fixed number of year for borrower, serve as a foundation with its age above all.

Fall in the premise that accords with loan requirement commonly, the age is smaller, its loan fixed number of years is longer, conversely the age is older, loan fixed number of year is briefer.

Normally the circumstance falls, " usurer age + loan fixed number of year does not exceed 65 years of " , it is the loan time that the bank can handle for its.

The room of loan building age: When the person that borrow money is buying house property, the " age " that buys house property will decide its can borrow money how many years to be restricted.

According to bank regulation, the house property with room newer age makes loan more easily.

Resemble building room period to be in 10 years the 2 hands room of less than, its each field requirement is better, the bank is willing to be accelerated to the housing loan of this kind of room age examine and approve speed.

And 70, of 80 time secondhand the room because building age is longer, the loan venture that the bank can control is opposite bigger, because this bank is right,the loan of this kind of building is examined and approve very careful.

The economic capacity of loan applicant: On the other hand, for the applicant that buys a house to loan, if work,circumstance of deposit of stability of income, job, deposit, asset also is the element that the bank thinks, also be time of application of oneself loan fixed number of year measure a factor.

The borrower with economic stronger actual strength can consider loan fixed number of year shorter, have the loan plan of certain reimbursement pressure.

Resemble 7 become 10 years or 15 years, even 6 to 5 become loan program.

And the borrower with economic a bit poor actual strength, need to notice whether oneself economy condition allows his to bear greater reimbursement pressure, if the side such as bank credit aptitude is better, this kind of crowd can be obtained likely highest the 8 loan into 20 years.

Loan buys room Baidu 100 divisions. . .

Did credit card to cannot borrow money buy a house? "

Do credit card to be able to buy a house, but if midway owes cost,still did not make credit stain do not take a money on time.

Your little brother used first your quota of people, yourself buys 2 flatlet head Fu Heli leads metropolis rise, general goods room is 40% pay commonly, 1.1 times interest rate, and need more bank running water and income proof.

Since your little brother used first your quota of people, you can use first quota of people of your little brother that now.

Had better not buy 2, of house property duty it's hard to say was about 9 years to come down now, although particular situation is bad still to say, but regular meeting is affected you bought 2.

Say additionally, the house that with you name buys is you, house property card is taken in one's hand hind want more the name can pay the fee of change the name of owner in a register with not small brushstroke into your little brother, if your little brother can be bought again,one flatlet just need not quarrel later.

What nevertheless your house buys is early, that affirmation can spend the one share fixed number of year of 70 years of property right, nevertheless that is the thing after a few years, whether can be torn open later change has it is not certain to deny compensation

The credit card 2 years ago has bad record, whether can you affect does loan buy a house now?

The credit card 2 years ago has bad record, if still be met without the word that pay off at present,the influence borrows money now exceed the time limit of the credit card that buy a house signs a letter on the meeting.

Credit card has final reimbursement day, after reimbursement day reimbursement, calculate credit exceed the time limit entirely, the letter is signed on all metropolis, have the following effect to the individual.

1. is enjoyed no longer avoid breath reimbursement.

2. influence individual asks for a letter to record 3. Serious exceed the time limit, amount is huge because of,still meet " ill will overdraws " make crime.

4. exceed the time limit exceeds 3 months or the bank urges a two second above to return not of reimbursement, silver-colored guild freezes your card and label you prohibit kind of client (blacklist) , still can sue bilk of your credit card and ill will to overdraw at the same time, the court is carried out compulsively.

Remarks: Credit card now and then exceed the time limit is not too serious to the individual's influence, should fill in time only return credit card to be able to be made up for.

A year in exceed the time limit does not exceed 4 times, not be too big to the individual's influence, if successive in March, even 7 months exceed the time limit, nearly 5 years in, cannot make any bank loan, credit.

Main content is as follows:

1 pay buy a car to buy room technology

2. credit card manages calorie of technology

3. credit card promotes frontal technology

Technology of 4. bank loan

If have demand